With the Fed backstopping big banks in the US, why would you hold capital in banks offshore?

Imagine you’re a multinational with global banking. What do you do? I’ll tell you what you do. You de-risk and shift your capital into these “systemically sensitive” US banks. That means banks outside of the US see capital flight.

Money pulled from Eurozone banks at record rate in February

Actually, the article linked above does a shoddy job of explaining what’s really happening. They blame the withdrawals on a host of things, few of which are actually relevant. The main cause is that described above.

This is why the crisis immediately hit European banks with Credit Suisse going tits up in a hurry. Granted, they’ve been on life support for God knows how long, but the point is that the Fed will have known all of this would take place. They’re not stupid. They knew full well what their actions would lead to. Now, take a look at European bank stocks. It’s like watching a horror film.

And those European bankers aren’t too happy. They, too, aren’t stupid and now they’re calling out the Wall Street bankers.

European financial regulators are fuming at “incompetent” US counterparts over SVB. For 15 years they attended “long and boring meetings” where everyone promised to do exactly the opposite of what the US just did when crisis struck.

Of course they are. They know they’re being rolled by the Wall Street banks, who are now eating their lunch and laughing while they lurch about and die.

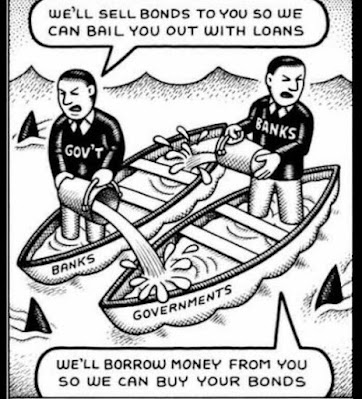

So there is an international financial war taking place. All wars are bankers’ wars. Remember that.

Outside of that, ultimately the Fed has a problem here as Ben Rickert of “Big Short” fame tweeted.

Too right. One thing I’d add to Ben’s commentary is this…

None of this “fighting inflation” BS is about doing so. It is a carefully orchestrated plan now unfolding to destroy many foreign banks and to consolidate financial power in the US banking system. From a geopolitical and certainly historical perspective, this is what happens as empires collapse. They see their dominance waning and always attempt to bolster the core while lashing out destroying those they can in order to shore up this core. As for the story the peasants get sold on inflation… pah.

This is like rubbing your tummy while patting your head. Try it, I dare you. You, or should I say, the central banks can fight inflation or bail out the banks. Not both.

So in the short to medium term, anything can happen, including a panic trade fearing demand destruction. In the long term, the elephant in the room (sovereign debt) just ate another baby elephant (US banks’ default risk).

This is the same reason that the banking crisis is not a one-off. It will shortly become a giant sovereign debt crisis, and then there is nobody to bail anybody else out.

When that day comes — and it’s closer than ever — you’ll want to be damn sure you’re far from the blast zone, because the sheer size of this is likely to bring down governments and cause mass civil unrest.

Unfortunately, this is known… which is why it becomes ever more probable they take us to war in order to deflect the blame, reset the debts, and retain control.

It’s unlikely to work, and even if it did, the results regarding bonds are the same — a wipe-out together with pension funds, which will bring down insurance companies, their annuity programs, and usher in a monetary crisis for the record books.

And yes, I know this all may sound rather radical and dramatic, but please realize this is just looking at basic maths and understanding cycles of history, thrown in with a sprinkling of a lifetime of studying the psychology of markets. I wish it wasn’t so, but hope is a shitty strategy for managing our money, so…

Surrender to the king!

~ See economist Michael Hudson's comments on the coming economic changes here

No comments:

Post a Comment